Undoubtedly, vulnerability to fraud can pose a catastrophic risk to any company, but it can mean life or death to a family business or SME. A typical organization loses 5% of revenue to fraud each year (ACFE: Report to Nations, 2014).

The best-case scenario is to equip business managers with the knowledge to identify any loopholes in the process that may lead to fraud. However, for most firms, this may not be the case due to limited resources.

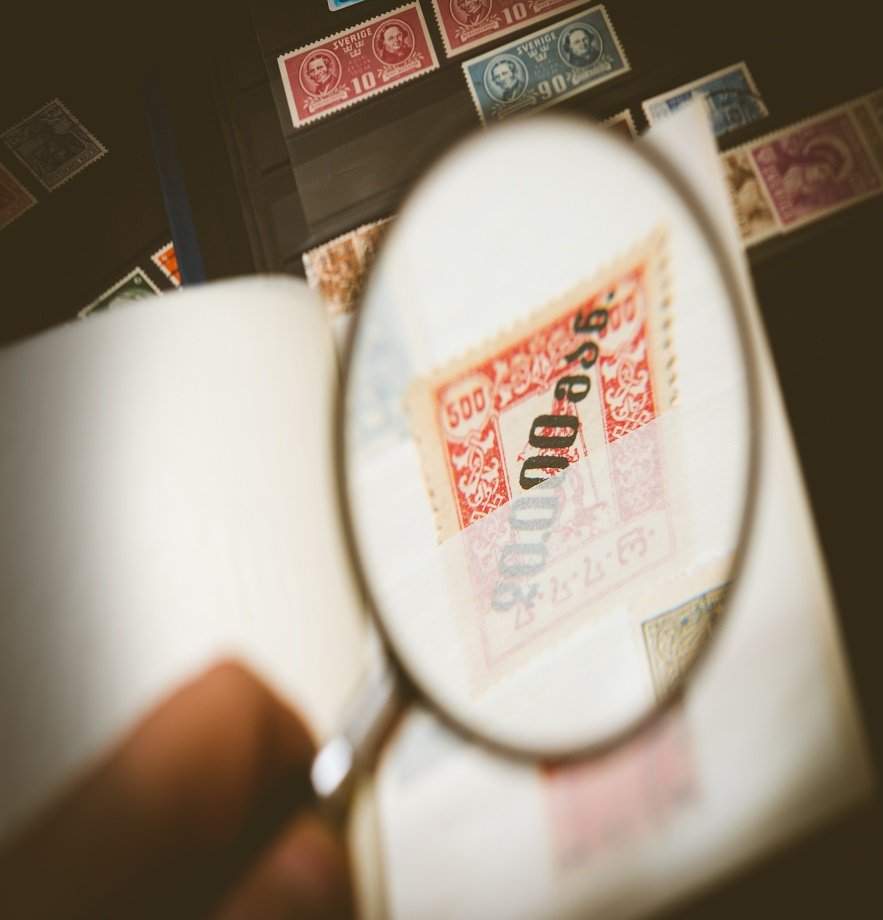

Fraud Examination is a specialized field and requires an understanding the intricate procedures and tools used in forensic auditing. A correctly performed fraud examination can:

Identify weaknesses in internal controls

Prevent future fraud

Identify employee responsible for misconduct

Facilitate the recovery of loss

How we can help

At Bizware, our team of qualified chartered accountants is well equipped with the knowledge of forensic accounting. Our tested approach helps us identify loopholes in the system and misstatement in the financial statements.

The activity is panned and performed to gather sufficient evidence against the wrongdoers to facilitate maximum recovery.

FAQs

An independent chartered accountant with the requisite skillset is the ideal person to perform a forensic audit.

A properly conducted forensic audit help gather enough evidence that ultimately facilitates recovery.

A forensic audit exposes internal control weakness and recommends necessary control that can prevent future frauds.

Recent Clients