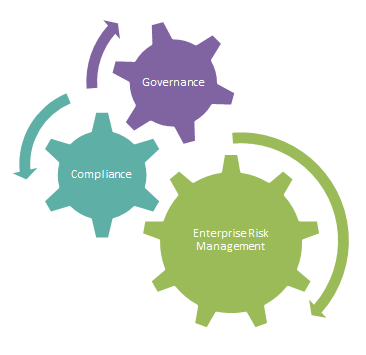

Corporate governance, risk management, and corporate compliance is the pathway to achieve performance goals.

Corporate governance sets the tone at the top and oversees business operations in light of the long-term organizational goals. It is a system of direction and control that dictates how a board of directors governs and manages a company. Principles of transparency, accountability, and security are typically included in a company's corporate governance structure. Poor governance can lead to the company's failure to achieve objectives and, in the worst case, can cause its collapse. The case of Enron Corp is a classic example of what poor corporate governance can do to a company.

GRC's second component is Enterprise Risk Management (ERM). It is a structured, consistent, and continuous process applied across an entire organization that allows companies to understand better and address material risks. Corporate boards, rating agencies, and regulatory bodies are among the key drivers for advancing ERM. The implementation of ERM can facilitate better capital resource allocation decisions, increase operational efficiency, and enhance a company's risk control efforts to support critical strategic, compliance, and governance initiatives.

Corporate compliance is as important as the other two components. The external compliance ensures the business operations are compliant with the laws and regulations. A study from Navex Global cited that almost two-thirds of organizations (63%) believe that their compliance efforts reduce the legal cost and resolution time of regulatory issues and fines. Internal compliance lays out a framework for the employees to follow the company/internal policies and procedures.

An integrated GRC approach is crucial to business growth and success.

How we can help

At Bizware we have a structured approach to align the governance structure with business objectives, while effectively managing risk and meeting compliance requirements.

Our comprehensive approach addresses the needs of board members, senior managers. We can help your organization apply an integrated approach to identifying and assessing business-critical risks, evaluating existing risk management infrastructure elements, and constructing continuous, in-depth ERM processes.

Our team of professionals has the most updated knowledge of the regulatory environment for most industries. We help you design a framework that ensures both internal and external compliance.

FAQs

It is advised to have an integrated approach for governance, risk management, and compliance to facilitate informed decision-making, achieve strategic goals, and meet internal and external stakeholders' expectations.

Recent Clients